Client: CIBC (Canadian Imperial Bank of Commerce)

Role: Lead User Experience Designer

Focus: UX Optimization • Accessibility • Conversion Design • Service Blueprinting

Project Overview

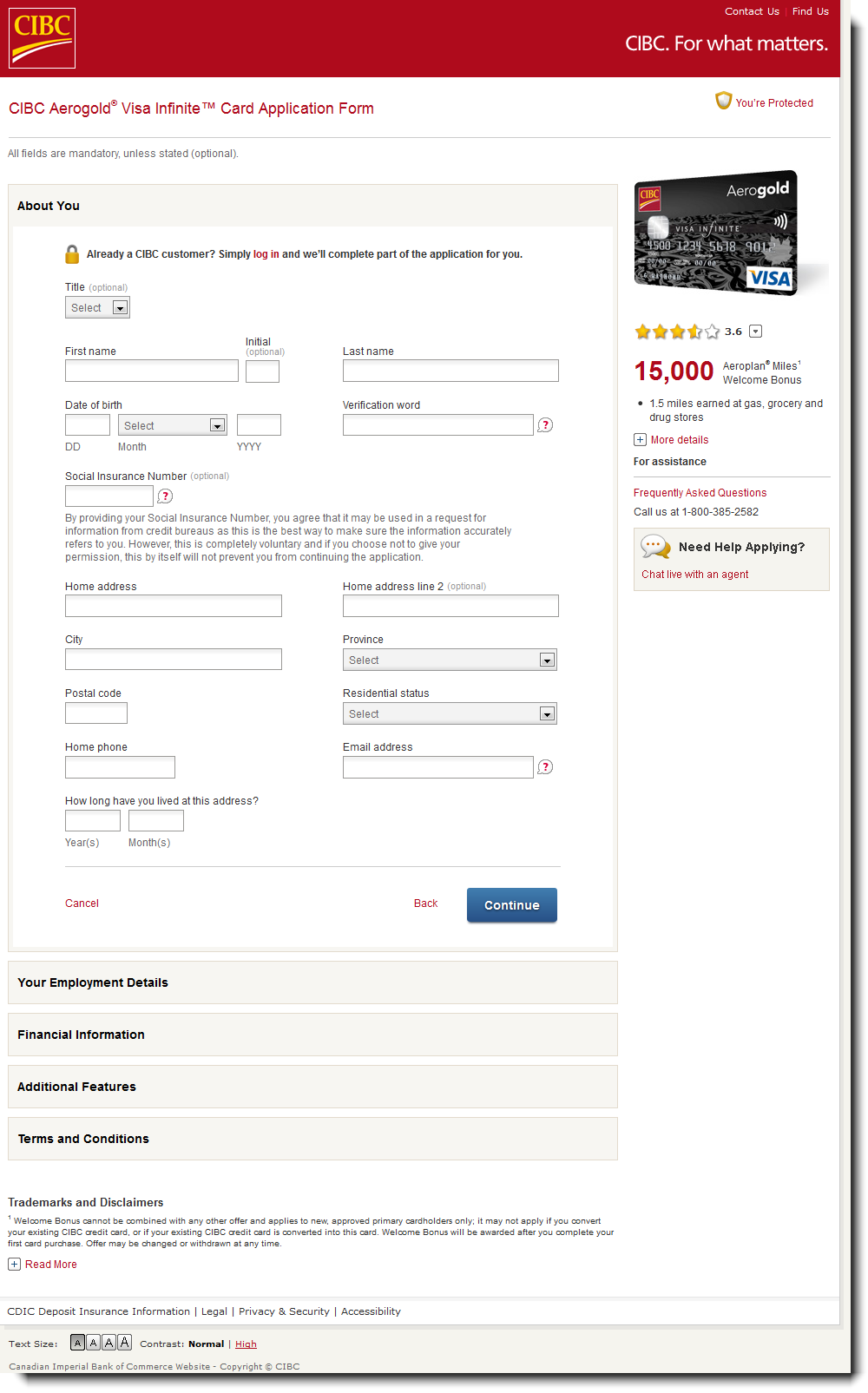

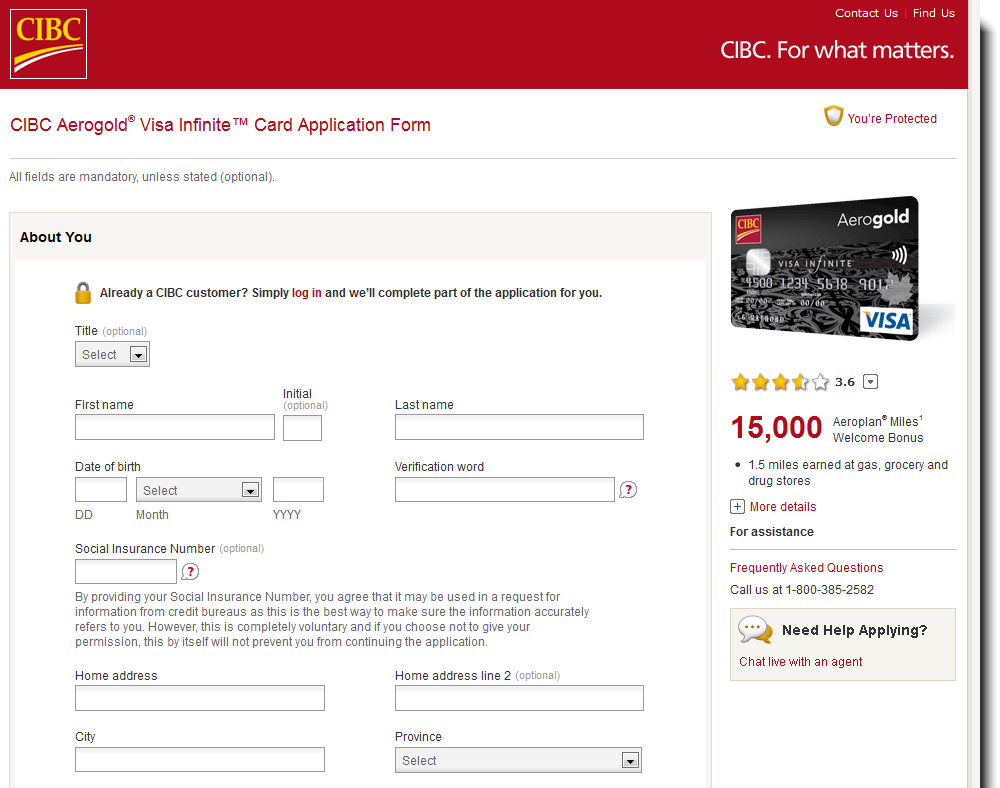

CIBC’s digital credit card application experience was outdated and underperforming.

Customers frequently dropped off before submission due to confusing forms, unclear progress indicators, and inaccessible interactions, particularly on mobile devices.

My mandate was to redesign the end-to-end digital credit card application flow to increase completion rates, improve accessibility compliance, and align the experience with CIBC’s enterprise design system and regulatory standards.

The goal: create a faster, clearer, and more inclusive experience that balances marketing flexibility, risk/compliance requirements, and customer usability.

The Challenge

- High abandonment rates: Analytics revealed users were dropping off mid-application, especially on mobile and at income verification steps.

- Accessibility compliance gaps: Existing form fields, color contrast, and labeling failed WCAG 2.1 AA standards.

- Regulatory constraints: Complex disclosure requirements and consent steps added friction to the flow.

- Lack of feedback mechanisms: Users were unsure of application status or missing fields during submission.

- Inconsistent experience: The credit card flow used different design patterns from CIBC’s main banking application process.

I was tasked with leading a human-centered redesign that would maintain compliance while dramatically improving clarity and ease of use.

My Role & Contributions

1. Discovery & Research

- Conducted end-to-end flow audits and identified critical pain points in the legacy process.

- Partnered with analytics and marketing to review conversion data, heatmaps, and field-level drop-offs.

- Interviewed users across segments (existing customers, new-to-bank) to understand barriers like jargon, trust, and perceived time commitment.

- Mapped the service ecosystem, including risk, fraud, and underwriting system integrations.

2. Journey Mapping & Experience Strategy

- Created a customer journey map highlighting emotional and cognitive friction throughout the application process.

- Designed a new service blueprint connecting front-end actions to back-end system validations.

- Defined key experience principles: clarity, transparency, accessibility, and responsiveness.

- Advocated for a “progressive disclosure” approach, showing only relevant questions at the right time.

3. Interaction & Information Design

- Designed mobile-first responsive layouts that scaled seamlessly across devices.

- Simplified the application into five intuitive stages:

- Choose Your Card

- Personal Details

- Employment Details

- Financial Information

- Additional Features and T&Cs

- Created real-time validation patterns to catch errors before submission.

- Added progress bars, contextual help, and plain-language microcopy for transparency.

- Developed accessible input controls, dropdowns, and error-handling patterns compliant with WCAG 2.1 AA.

4. Accessibility & Compliance Integration

- Collaborated with CIBC’s Accessibility Office to validate all flows with JAWS, NVDA, and WAVE testing.

- Ensured color contrast, keyboard focus, ARIA labels, and screen-reader flow met AODA and WCAG standards.

- Simplified legal and regulatory language into readable, plain-language disclosures.

- Documented accessibility acceptance criteria in JIRA for QA sign-off.

5. Collaboration & Delivery

- Partnered with product owners, developers, and compliance officers through Agile sprints.

- Delivered annotated wireframes, prototypes, and UX documentation in Figma and Confluence.

- Supported implementation QA and accessibility testing prior to launch.

- Provided design governance and system components reused across other CIBC acquisition journeys.

Outcomes & Impact

- Increased credit card application completion rate by 32%.

- Reduced form abandonment by 28%.

- Achieved full WCAG 2.1 AA compliance and passed AODA audit.

- Established reusable credit application patterns now applied to CIBC’s loans and line-of-credit flows.

- Enhanced customer trust through improved language, security cues, and visual feedback.

Reflection

This project highlighted my strength in translating regulated financial processes into intuitive, user-centered experiences.

By balancing compliance, accessibility, and conversion strategy, I helped CIBC deliver a seamless digital onboarding experience that feels modern, transparent, and inclusive.