Context

RBC Express is a comprehensive online banking platform serving business clients with advanced cash management needs. As digital transactions became the norm, businesses began to require faster, more secure, and fully automated ways to receive and reconcile incoming electronic payments. In response, RBC aimed to integrate the Interac e-Transfer Autodeposit feature into the RBC Express platform, allowing companies to receive funds instantly and securely, without manual intervention.

Challenge

The key challenge was designing an experience that streamlined the Autodeposit registration and management for enterprise users, while ensuring robust security, auditability, and clarity – critical requirements in high-value business transactions. The solution needed to accommodate complex approval hierarchies and varied operational workflows typical in midsize to large organizations. Additionally, it was important to foster user trust in the safety and reliability of automatic deposits within an established financial ecosystem.

Process and Approach

- Led user research sessions to map out payment workflows, identify pain points, and gather feedback from business banking clients.

- Collaborated with RBC’s technical and business teams to define system requirements, focusing on clear communication, permission control, and notification handling throughout the registration and transaction life cycle.

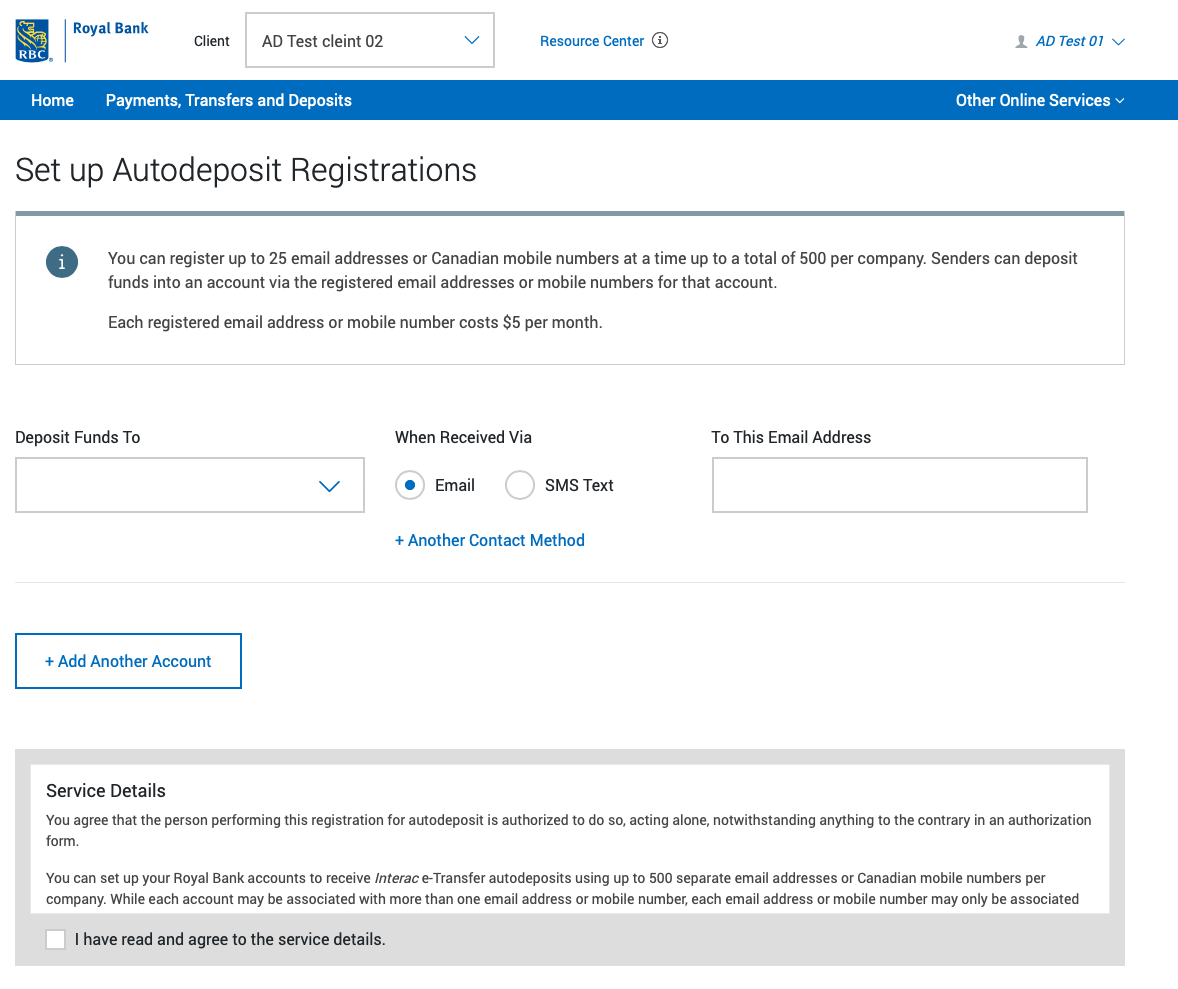

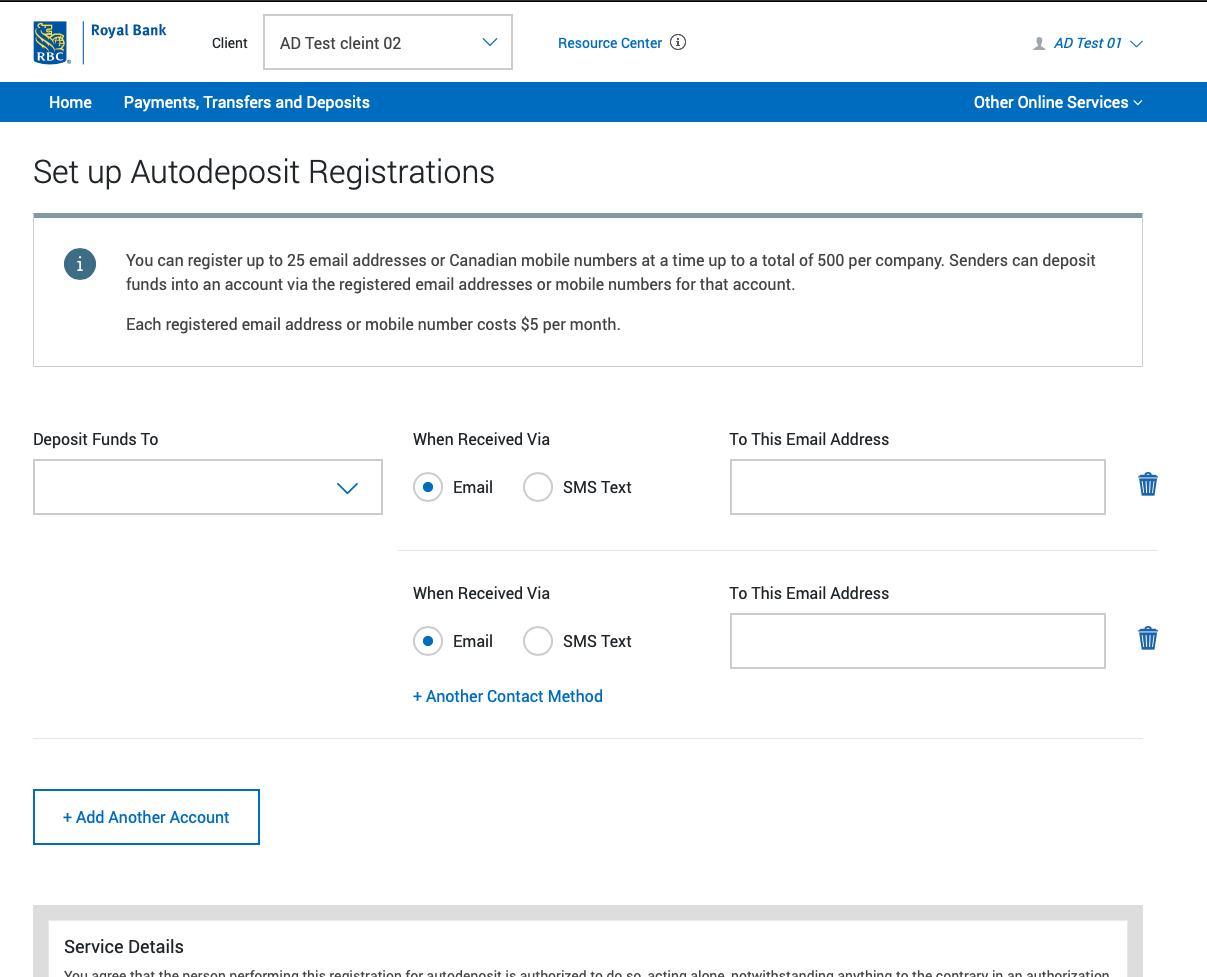

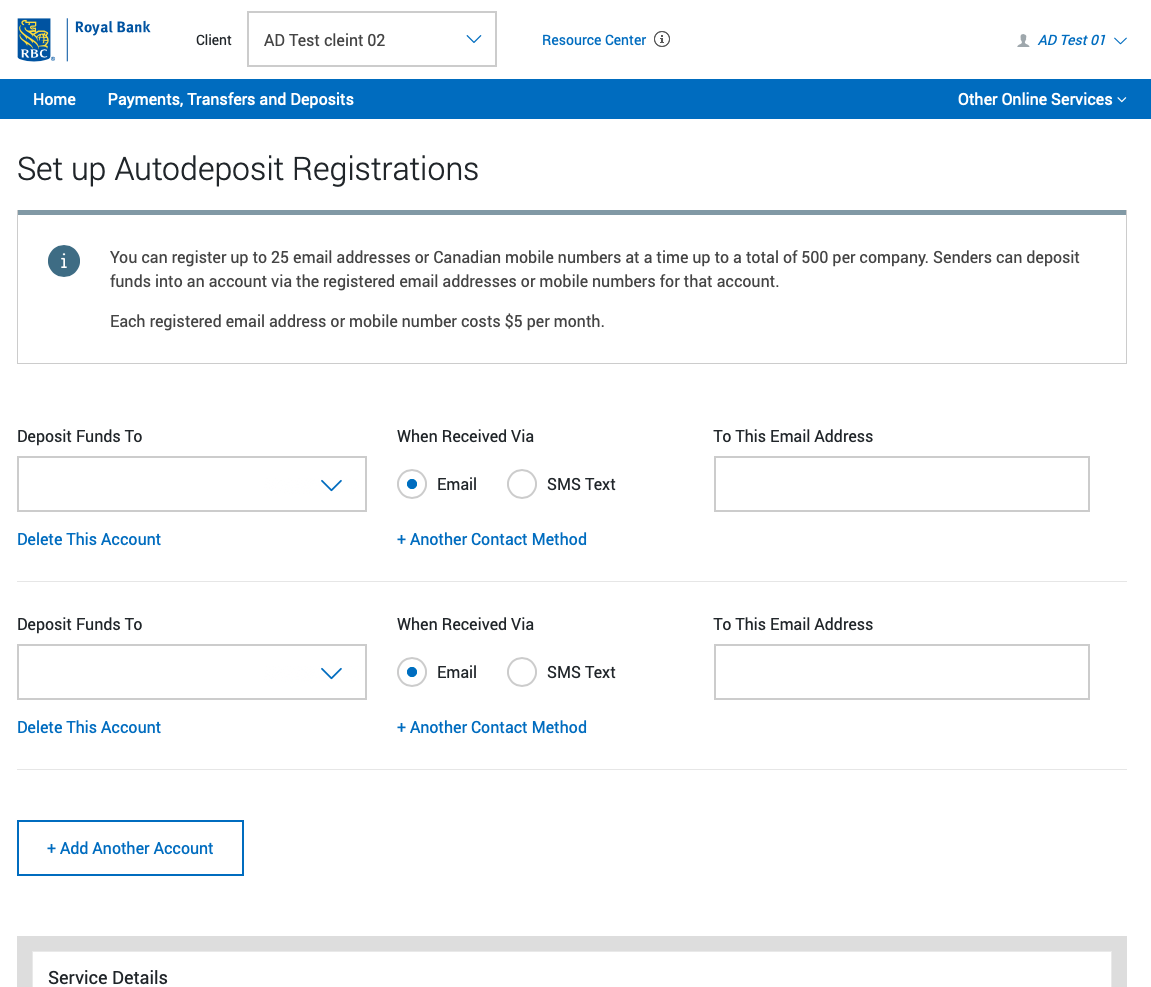

- Created detailed wireframes, prototypes, and UI components for the registration, setup, and management of Autodeposit, ensuring smooth integration with existing RBC Express workflows.

- Iteratively tested interactive prototypes with stakeholders and real business users, refining the design to reduce friction, clarify instructions, and optimize multi-step processes.

- Developed comprehensive documentation and training materials, supporting users in onboarding and leveraging the Autodeposit feature for their daily operations.

Outcome

The project delivered a seamless and secure Autodeposit experience within RBC Express, enabling business clients to receive payments directly and instantly into their accounts, with automated reconciliation and no need for manual intervention. User adoption increased due to the streamlined experience, and the solution strengthened RBC’s competitive position by providing industry-leading, client-centric features. The new workflows significantly reduced administrative burden and error rates while upholding the highest security and compliance standards expected from a major financial institution.