Reflection

This project showcased your ability to bridge complex data systems, security requirements, and human-centered design in a highly regulated environment. By simplifying how users access and execute cross-border payments, you helped RBC deliver a smarter, faster, and more transparent global banking experience for its commercial clients.

Client: RBC Royal Bank (Commercial Business Banking Division)

Role: Senior User Experience Designer

Project Overview

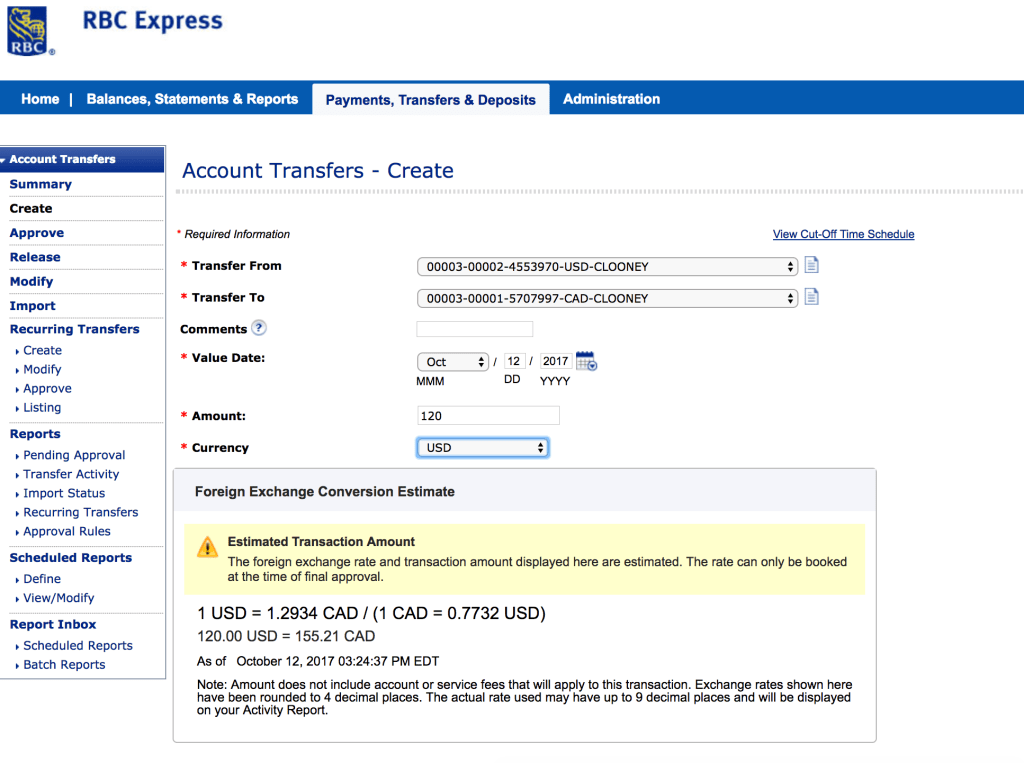

RBC Express is RBC’s flagship digital platform for commercial and corporate clients, enabling businesses to manage payments, cash flow, and global financial operations.

The Foreign Exchange (FX) Integration initiative aimed to embed real-time FX rates and cross-border payment functionality directly into RBC Express, creating a seamless experience for treasury managers and finance teams handling international transactions.

The redesign unified multiple legacy systems, previously accessible only through separate portals into a single, secure, responsive, and accessible digital environment.

The Challenge

RBC’s existing foreign exchange workflows were:

- Fragmented across web portals and internal applications, requiring multiple logins.

- Lacking in real-time data visibility, forcing users to reference external FX sources.

- Burdened with complex, form-based interfaces unsuitable for mobile use.

- Inconsistent with the enterprise design system and inaccessible under WCAG standards.

The design challenge was to streamline global payments and currency conversion within the existing RBC Express platform, while maintaining enterprise security and regulatory compliance.

My Role & Contributions

As the Lead UX Designer, I drove the entire design process from discovery through delivery, bridging product management, technology, and compliance teams.

- Discovery & Stakeholder Alignment

- Partnered with product managers, FX traders, and compliance officers to define goals, user scenarios, and risk thresholds.

- Conducted workflow analysis and contextual interviews with corporate treasury users managing high-volume transactions.

- Mapped the end-to-end journey of international payments, highlighting system dependencies and hand-offs between back-office FX systems and user-facing interfaces.

- Information Architecture & Service Mapping

- Designed the integrated service blueprint linking FX rate data feeds, payment modules, and reporting dashboards.

- Created clear, modular layouts supporting multi-currency entry, preview, and approval flows.

- Ensured scalability for future integrations (hedging tools, predictive rate modeling).

- Interaction Design & Prototyping

- Designed responsive web prototypes in Figma and Axure, aligning with RBC’s design system standards.

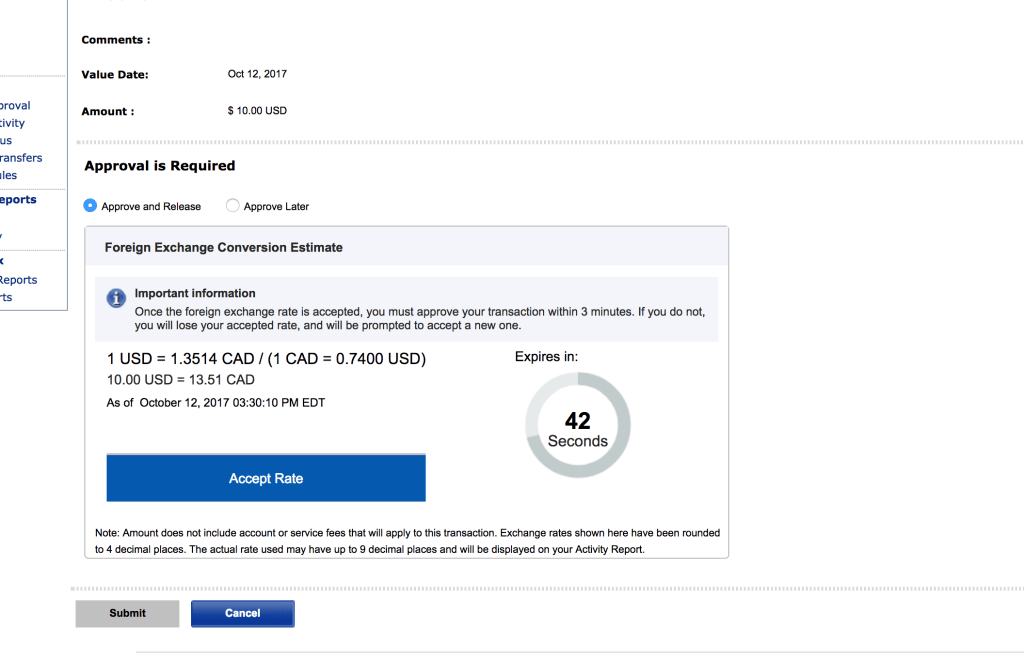

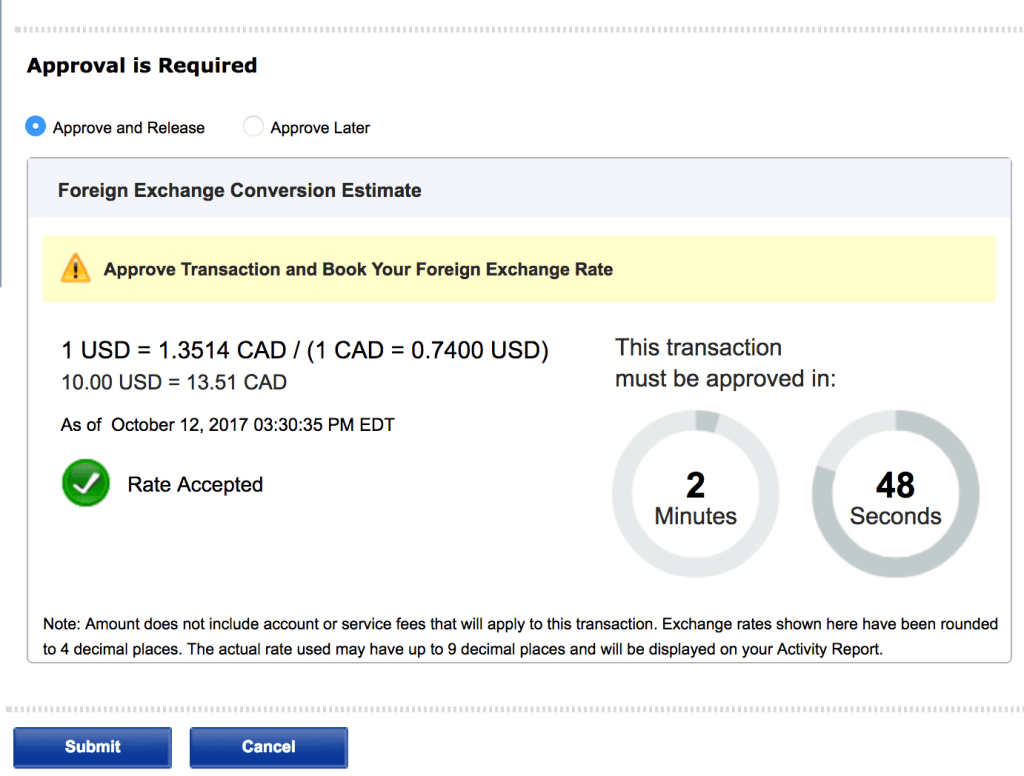

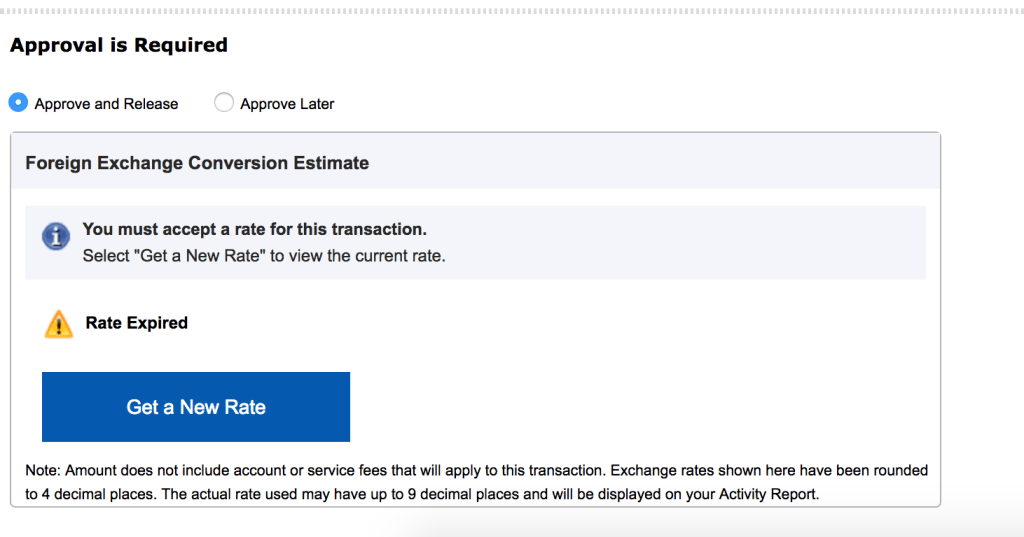

- Introduced progressive disclosure patterns to reduce cognitive load for complex transaction flows.

- Added real-time validation, error handling, and confirmation modals optimized for high-stakes financial actions.

- Accessibility & Compliance

- Ensured WCAG 2.1 AA compliance across all interaction states and data tables.

- Worked with QA to verify keyboard navigation, ARIA labeling, and contrast ratios for complex financial data visualizations.

- Testing & Iteration

- Facilitated usability sessions with commercial users to validate flow comprehension and trust signals in currency conversions.

- Iterated designs based on insights from financial operations teams and RBC’s global compliance partners.

- Collaboration & Delivery

- Partnered with architects and developers to translate interaction logic into system requirements.

- Documented and delivered a full UX specification package with annotated user flows, accessibility notes, and content guidance.

Outcomes & Impact

- Consolidated multiple FX workflows into a single, unified experience within RBC Express.

- Reduced average transaction completion time by 25%, increasing efficiency for corporate users.

- Enhanced accuracy and trust through real-time FX rate display and confirmation logic.

- Achieved full WCAG 2.1 AA compliance and aligned the new experience with RBC’s design system.

- Supported measurable improvement in client adoption of international payment services.