Client: TD Insurance

Role: Senior User Experience Designer (Lead)

Focus: Accessibility • UX Modernization • Conversion Optimization • Service Blueprinting

Project Overview

TD wanted to modernize its Auto Insurance Smart Quoter, the web-based experience that allows customers to compare coverage, adjust deductibles, and obtain a personalized quote.

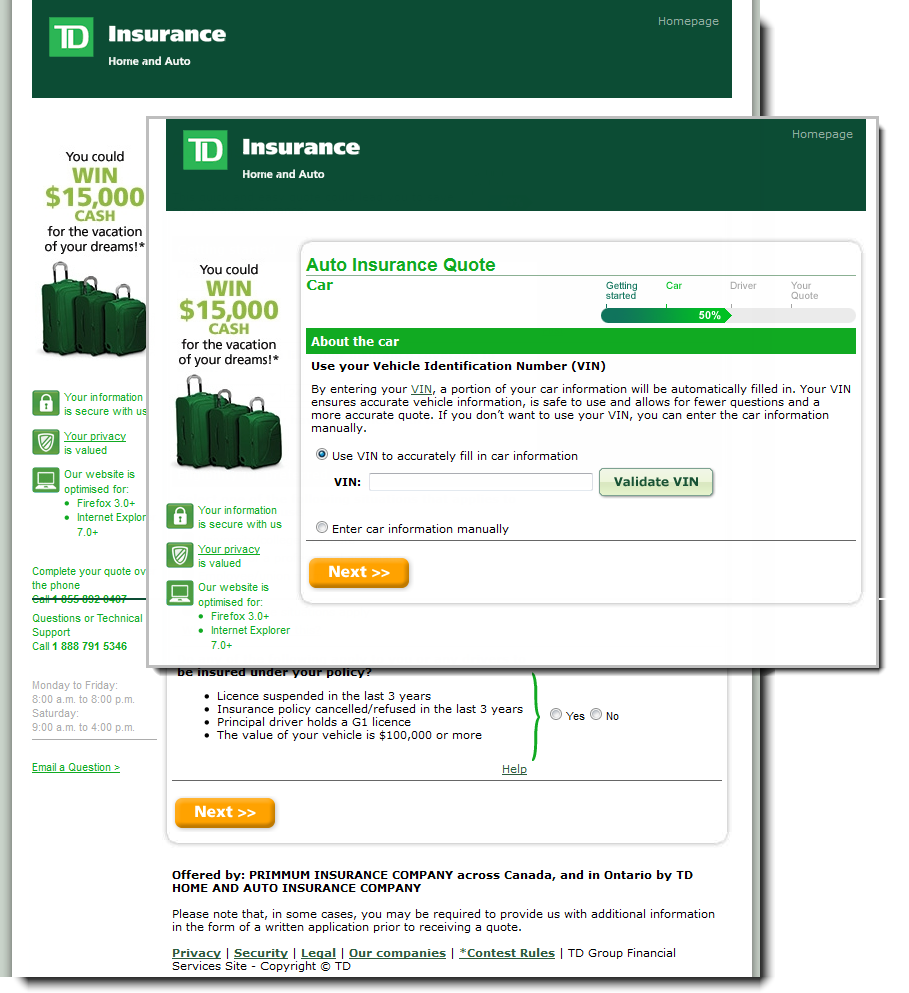

The existing platform was functional but complex: dense forms, unclear language, and inconsistent accessibility compliance caused user friction and high drop-off rates. The goal was to create a simpler, faster, and fully accessible quoting journey that met strict AODA and WCAG standards while improving usability and conversion.

The Challenge

- Complex user flow: Users had to navigate multiple screens with redundant inputs.

- Low accessibility compliance: Form fields, contrast, and error messaging did not meet WCAG standards.

- Regulatory and compliance constraints: Insurance disclosure requirements made simplification tricky.

- Mobile usability gaps: The experience wasn’t optimized for mobile or tablet quoting.

- Inconsistent design language: The Quoter UI deviated from TD’s evolving design system.

My mandate was to lead a redesign that balanced regulatory accuracy, performance, and user clarity.

Role & Contributions

1. Discovery & Research

- Conducted usability testing and heuristic reviews to identify friction points in the current journey.

- Analyzed data on quote abandonment and time-on-page to understand conversion barriers.

- Collaborated with business analysts, underwriters, and product owners to clarify input logic and eligibility rules.

2. Service Mapping & Blueprinting

- Created a service blueprint mapping user actions, system triggers, and back-end data dependencies.

- Identified redundant interactions and opportunities for automation and pre-fill logic.

- Outlined the “ideal journey” from quote initiation to policy bind.

3. Accessibility & Inclusive Design

- Embedded WCAG 2.1 AA standards at every stage of design: contrast ratios, keyboard navigation, field labeling, and screen-reader behavior.

- Facilitated co-design workshops with TD’s accessibility specialists and legal/compliance teams.

- Introduced plain-language content for questions and disclosures, improving readability and trust.

4. Interaction & Visual Design

- Designed responsive wireframes and prototypes, aligned with TD’s enterprise design system.

- Simplified multi-page quoting into a progressive disclosure flow, users answered only relevant questions.

- Added real-time feedback and progress indicators to reduce perceived complexity.

- Created reusable, accessible form components (input fields, selectors, modals) for the shared TD design library.

5. Collaboration & Delivery

- Worked in Agile sprints using JIRA and Confluence to manage backlog items and design hand-offs.

- Documented design rationale, compliance notes, and success criteria for audit readiness.

Outcomes & Impact

- Achieved full WCAG compliance, meeting both AODA and TD internal accessibility standards.

- Reduced quote completion time by 35% through form simplification and progressive flow.

- Improved quote-to-application conversion rate by 20% within three months post-launch.

- Lowered support inquiries related to online quoting by 25%, thanks to improved error handling and clarity.

- Reusable accessible component library adopted for other TD Insurance products (Travel, Home).

Reflection

This project exemplified your approach to inclusive, data-driven design, balancing business rules, regulatory compliance, and human usability.

By embedding accessibility from discovery through delivery, I helped TD Insurance transform a technical quoting process into a trustworthy, transparent, and friction-free experience for all users.